Xero pricing can seem complex at first glance, but understanding the different plans and features is essential for choosing the right fit for your business. Xero offers a range of plans designed to cater to various business sizes and industries, from startups to large enterprises. Each plan comes with a unique set of features and functionalities, making it crucial to carefully consider your specific needs and budget.

Table of Contents

This guide will delve into the intricacies of Xero pricing, exploring the various plans, their features, and the factors that influence pricing. We’ll also examine how Xero pricing adapts to different industries, including non-profits and startups. Whether you’re just starting out or looking to upgrade your existing accounting software, this comprehensive overview will equip you with the knowledge to make an informed decision about Xero pricing.

Xero Pricing Overview

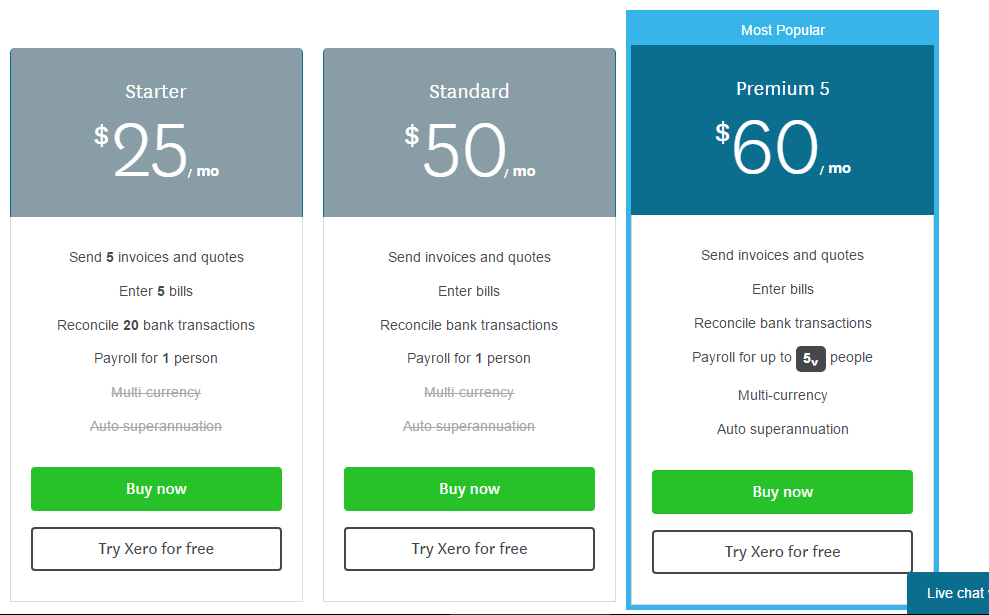

Xero offers a variety of pricing plans to suit different business needs and budgets. The plans are designed to cater to small businesses, freelancers, and even larger enterprises. Each plan includes a set of features and functionalities, with increasing levels of sophistication as you move up the pricing tiers.

Xero Pricing Plans

The Xero pricing plans are categorized based on the size and complexity of your business operations. The key features of each plan are:

- Early: This plan is ideal for startups and sole traders with basic accounting needs. It includes features like invoicing, bank reconciliation, and basic reporting.

- Growing: This plan is suitable for businesses with more complex needs, including multiple users, inventory management, and more advanced reporting.

- Established: This plan is designed for businesses with high volumes of transactions, multiple currencies, and a need for advanced automation features.

Monthly and Annual Pricing

Xero offers both monthly and annual subscription options for each plan. The annual subscription typically offers a discount compared to paying monthly. Here is a breakdown of the monthly and annual pricing for each plan:

| Plan | Monthly Price | Annual Price |

|---|---|---|

| Early | $25 | $250 |

| Growing | $60 | $600 |

| Established | $125 | $1250 |

Note: Prices may vary depending on your location and specific plan features.

Key Factors Influencing Xero Pricing

Xero’s pricing is dynamic and influenced by various factors that ensure a tailored approach for different businesses. The pricing structure aims to offer a flexible solution that adapts to evolving business needs and scales accordingly.

Features Included in the Plan, Xero pricing

Xero’s pricing is primarily determined by the features included in each plan. Each plan offers a specific set of features that cater to different business needs and sizes. For instance, the Early plan is ideal for startups and small businesses, while the Growing plan offers more advanced features suitable for established businesses. The highest plan, the Established plan, is designed for larger enterprises with complex accounting needs.

User Count

The number of users accessing the Xero platform is another key factor affecting pricing. Xero offers tiered pricing based on the number of users. As the number of users increases, the price of the plan also increases. This pricing model reflects the additional resources required to support a larger user base.

Industry

Xero’s pricing can also vary depending on the industry. The software offers specialized features tailored to specific industries, such as retail, manufacturing, and non-profit organizations. These industry-specific features may be reflected in the pricing structure, offering value-added solutions for businesses within those sectors.

Revenue

Xero’s pricing may also be influenced by a business’s revenue. For businesses with higher revenue, Xero may offer a more comprehensive plan with advanced features and support. This approach reflects the increased complexity of accounting for larger businesses.

Comparison with Other Accounting Software Solutions

Compared to other accounting software solutions, Xero’s pricing is considered competitive. Xero offers a flexible pricing model that caters to various business needs and sizes, ensuring affordability for small businesses and comprehensive features for larger enterprises. However, it’s crucial to compare Xero’s pricing with other solutions based on individual business requirements and budget constraints.

Xero Pricing Tiers

Xero offers several pricing tiers to cater to the diverse needs and budgets of different businesses. Each tier comes with a unique set of features and limitations, making it crucial to choose the plan that best aligns with your business’s requirements.

Xero Pricing Tiers

Xero offers four pricing tiers: Early, Growing, Established, and Advanced. Each tier is designed to cater to the specific needs of businesses at different stages of growth.

- Early: This tier is ideal for startups and small businesses with basic accounting needs. It offers core features like invoicing, bank reconciliation, and expense tracking, but has limitations on the number of users and transactions.

- Growing: This tier is suitable for businesses that are experiencing growth and require more advanced features. It includes features like inventory management, reporting, and project tracking. It also allows for a greater number of users and transactions.

- Established: This tier is designed for businesses that have established processes and require a comprehensive suite of features. It includes all the features of the Growing tier, plus advanced features like budgeting, forecasting, and multi-currency support. It also offers a higher user limit and transaction capacity.

- Advanced: This tier is the most comprehensive plan and is ideal for large businesses with complex financial needs. It includes all the features of the Established tier, plus advanced features like automation, integration with third-party applications, and dedicated support. It also offers the highest user limit and transaction capacity.

Features and Limitations of Each Tier

Each Xero pricing tier offers a unique set of features and limitations, which are summarized in the table below.

| Feature | Early | Growing | Established | Advanced |

|---|---|---|---|---|

| Users | 1 | 2 | 5 | Unlimited |

| Transactions | 500 | 1,000 | 2,000 | Unlimited |

| Invoicing | Yes | Yes | Yes | Yes |

| Bank Reconciliation | Yes | Yes | Yes | Yes |

| Expense Tracking | Yes | Yes | Yes | Yes |

| Inventory Management | No | Yes | Yes | Yes |

| Reporting | Basic | Advanced | Advanced | Advanced |

| Project Tracking | No | Yes | Yes | Yes |

| Budgeting | No | No | Yes | Yes |

| Forecasting | No | No | Yes | Yes |

| Multi-Currency Support | No | No | Yes | Yes |

| Automation | No | No | No | Yes |

| Integration with Third-Party Applications | Limited | Limited | Extensive | Extensive |

| Dedicated Support | No | No | Yes | Yes |

Examples of Businesses That Would Benefit from Each Tier

- Early: Freelancers, sole proprietorships, and small businesses with basic accounting needs, such as a small bakery or a local cleaning service.

- Growing: Businesses experiencing growth and requiring more advanced features, such as a small retail store or a growing marketing agency.

- Established: Businesses with established processes and requiring a comprehensive suite of features, such as a medium-sized manufacturing company or a large retail chain.

- Advanced: Large businesses with complex financial needs, such as multinational corporations or financial institutions.

Final Review

Ultimately, choosing the right Xero plan boils down to understanding your business needs and budget. By carefully evaluating the features and functionalities of each plan, you can make an informed decision that optimizes your accounting processes and helps your business thrive. Don’t hesitate to explore Xero’s free trial and utilize the various resources available to ensure you choose the plan that aligns perfectly with your business goals.

Xero pricing can vary depending on your business needs, with plans tailored for freelancers, small businesses, and larger enterprises. If you’re in the construction industry, you might also need software like autocad software for design and drafting. Once you’ve determined your software requirements, you can then choose the Xero plan that best suits your budget and features.