TurboTax Online simplifies the often-dreaded process of filing taxes, offering a user-friendly platform and comprehensive tools for individuals and families. From basic tax returns to complex financial situations, TurboTax Online provides guidance and support throughout the tax season.

Table of Contents

Whether you’re a student, a seasoned investor, or a small business owner, TurboTax Online offers tailored features to meet your specific needs. Its intuitive interface, step-by-step guidance, and extensive resources make it a popular choice for many taxpayers.

TurboTax Online Overview

TurboTax Online is a popular tax preparation software that helps individuals and families file their federal and state income taxes. It offers a variety of features designed to simplify the tax filing process and ensure accuracy.

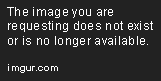

TurboTax Online Plans and Pricing

TurboTax Online offers different plans to cater to various tax situations and needs. Each plan includes a set of features and comes with a corresponding price.

- Free Edition: This plan is suitable for simple tax situations, such as those with limited income and standard deductions. It allows users to file federal and state returns for free.

- Deluxe Edition: This plan is designed for individuals and families with more complex tax situations, including those with itemized deductions, homeownership, or investment income. It offers features such as maximizing deductions, guidance on credits, and support for various tax forms.

- Premier Edition: This plan is ideal for individuals and families with complex tax situations, including those with rental properties, capital gains and losses, or self-employment income. It provides advanced features like personalized tax advice, guidance on investment strategies, and support for specific tax forms.

- Self-Employed Edition: This plan is specifically designed for self-employed individuals and small business owners. It offers features such as maximizing deductions for business expenses, guidance on self-employment taxes, and support for specific tax forms.

- TurboTax Live: This plan offers access to certified public accountants (CPAs) and enrolled agents (EAs) who can provide personalized tax advice and support throughout the filing process. Users can connect with a tax expert through live chat or video calls for guidance and assistance with specific tax questions or complex tax situations.

Target Audience for TurboTax Online

TurboTax Online is designed for a wide range of individuals and families, including:

- Individuals with simple tax situations: The Free Edition is suitable for those with limited income and standard deductions.

- Individuals and families with more complex tax situations: The Deluxe, Premier, and Self-Employed Editions cater to individuals and families with itemized deductions, homeownership, investment income, rental properties, capital gains and losses, or self-employment income.

- Individuals who prefer online tax filing: TurboTax Online offers a convenient and user-friendly online platform for tax preparation.

- Individuals who need assistance with specific tax questions: TurboTax Live offers access to certified tax professionals who can provide personalized advice and support.

TurboTax Online Features

TurboTax Online offers a range of features designed to simplify the tax preparation process for individuals and families. These features provide users with tools and resources to help them file accurate returns, maximize their refunds, and ensure compliance with tax laws.

Tax Preparation Tools and Resources

TurboTax Online offers a variety of tools and resources to assist users in preparing their tax returns. These tools include:

- Tax calculators: These calculators help users estimate their tax liability, potential refund, and the impact of various deductions and credits on their overall tax burden. For example, users can use a retirement calculator to estimate the amount they can contribute to their retirement accounts and still benefit from tax deductions.

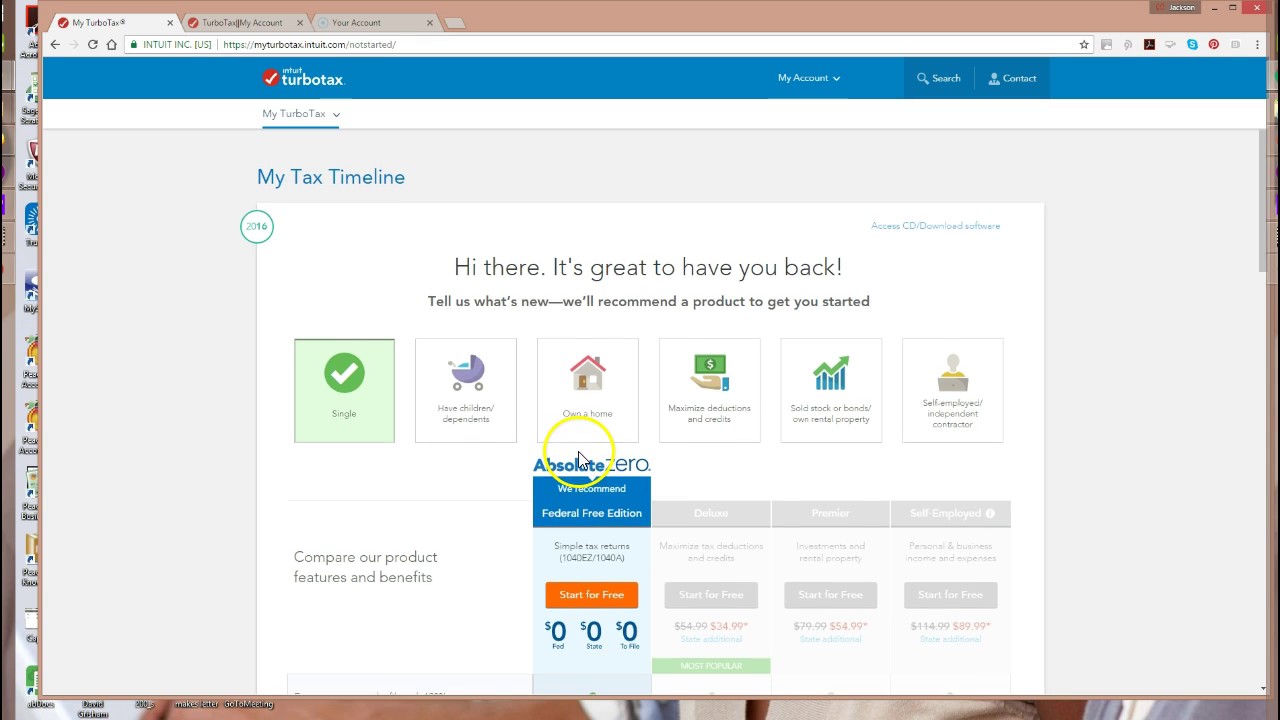

- Personalized guidance: TurboTax Online uses a question-and-answer format to guide users through the tax preparation process. Based on their responses, the software identifies relevant tax forms, deductions, and credits that the user may be eligible for.

- Tax tips and advice: The software provides users with helpful tips and advice on various tax-related topics, such as deductions, credits, and tax planning strategies. This information can help users make informed decisions about their tax obligations and maximize their financial benefits.

- Tax audit support: In case of a tax audit, TurboTax Online offers support and guidance to users. The software can help users gather the necessary documentation and respond to IRS inquiries.

Supported Tax Forms

TurboTax Online supports a wide range of tax forms, including:

- Form 1040: The primary tax form used by most individuals to report their income and calculate their tax liability.

- Schedule A: This form is used to itemize deductions, such as medical expenses, charitable contributions, and state and local taxes.

- Schedule C: This form is used by self-employed individuals to report their business income and expenses.

- Schedule D: This form is used to report capital gains and losses from the sale of assets, such as stocks, bonds, and real estate.

- Form 1099: This form is used to report income from various sources, such as interest, dividends, and payments from independent contractors.

Handling Complex Tax Situations

TurboTax Online is equipped to handle complex tax situations, such as deductions and credits. The software features:

- Deduction and credit identification: TurboTax Online analyzes user information and identifies potential deductions and credits they may be eligible for. This includes deductions for homeownership, charitable contributions, student loan interest, and more.

- Deduction and credit optimization: The software helps users optimize their deductions and credits to maximize their tax savings. It guides users through the process of claiming eligible deductions and credits, ensuring they take advantage of all available tax benefits.

- Tax advice and support: TurboTax Online provides users with tax advice and support from qualified tax professionals. Users can access live assistance through phone, chat, or email to address complex tax situations and receive personalized guidance.

TurboTax Online User Experience

TurboTax Online is designed to be user-friendly, guiding you through the tax preparation process with clear instructions and intuitive navigation. The software’s user-friendly interface and step-by-step guidance make it accessible to taxpayers of all experience levels.

Ease of Use and Navigation

TurboTax Online offers a streamlined and intuitive user experience, making it easy for users to navigate the tax preparation process. The software’s guided interview format helps users answer questions relevant to their individual circumstances. The software automatically calculates deductions and credits, ensuring that users maximize their tax savings.

Customer Support Options

TurboTax Online provides comprehensive customer support options to assist users with any questions or issues they may encounter. These options include:

- Online Help Center: The TurboTax Online Help Center offers a vast library of articles, FAQs, and videos that address common tax questions and provide step-by-step guidance on using the software.

- Live Chat: Users can access live chat support for immediate assistance from a TurboTax representative. This option is available during specific hours, typically during peak tax season.

- Phone Support: TurboTax offers phone support for users who prefer a more personalized interaction. Representatives are available to answer questions and provide guidance on tax-related matters.

- Email Support: Users can submit their questions or concerns via email, and TurboTax representatives will respond within a reasonable timeframe.

Comparison of User Interfaces

The user interface of TurboTax Online is known for its simplicity and ease of use. Here’s a comparison with other popular tax preparation software:

| Feature | TurboTax Online | H&R Block | TaxAct |

|---|---|---|---|

| User Interface | Clean and intuitive, guided interview format | User-friendly, but can be overwhelming for beginners | Simple and straightforward, good for basic returns |

| Navigation | Easy to navigate, clear step-by-step guidance | Can be complex, requires some navigation skills | Straightforward navigation, easy to find specific sections |

| Customer Support | Comprehensive, including live chat, phone, and email | Limited live chat, phone support available | Limited live chat, phone support available |

TurboTax Online Security and Privacy

TurboTax Online prioritizes the security and privacy of its users’ financial information. The platform employs robust measures to safeguard sensitive data, ensuring users can confidently file their taxes online.

Data Encryption

TurboTax Online encrypts all user data transmitted between the user’s device and the TurboTax servers. This means that the data is scrambled and unreadable to anyone except authorized personnel.

TurboTax Online uses industry-standard encryption protocols like Transport Layer Security (TLS) and Secure Sockets Layer (SSL) to protect user data during transmission.

- Encryption Key: TurboTax Online uses a unique encryption key to encrypt each user’s data. This key is stored securely and is not accessible to unauthorized individuals.

- Data Storage: Once data reaches the TurboTax servers, it is stored in secure data centers with advanced physical and digital security measures. These data centers have 24/7 monitoring and access control to prevent unauthorized access.

Privacy Policy and Compliance

TurboTax Online maintains a comprehensive privacy policy that Artikels how user data is collected, used, and protected. The platform adheres to industry best practices and complies with relevant regulations, including:

- General Data Protection Regulation (GDPR): TurboTax Online is committed to protecting the personal data of individuals in the European Union. The platform complies with the GDPR’s requirements for data processing, consent, and data subject rights.

- California Consumer Privacy Act (CCPA): TurboTax Online complies with the CCPA’s provisions for data access, deletion, and opt-out rights for California residents.

- Financial Industry Regulatory Authority (FINRA): TurboTax Online complies with FINRA’s rules and regulations regarding the protection of customer information.

TurboTax Online Integrations

TurboTax Online offers several integrations with other financial tools and services, designed to simplify tax preparation and make it easier for users to manage their finances. These integrations allow users to directly import financial data, track expenses, and access other relevant financial information from within the TurboTax Online platform.

Integrations with Financial Institutions

Users can connect their bank accounts, credit cards, and investment accounts to TurboTax Online. This allows them to automatically import financial transactions, including income, expenses, and investment details. These integrations eliminate the need for manual data entry, reducing the risk of errors and saving users significant time.

- Automatic Data Import: Users can import financial data directly from their bank accounts, credit cards, and investment accounts, eliminating the need for manual data entry and reducing the risk of errors.

- Simplified Expense Tracking: The integration with financial institutions allows users to automatically track expenses, making it easier to categorize and claim eligible deductions.

- Enhanced Accuracy: By importing financial data directly from financial institutions, users can ensure the accuracy of their tax returns, minimizing the risk of audits or penalties.

Integrations with Financial Planning Tools, Turbotax online

TurboTax Online integrates with various financial planning tools, allowing users to access their financial information and track their progress toward financial goals. These integrations provide a holistic view of users’ financial situation, making it easier to make informed decisions about their taxes and finances.

- Comprehensive Financial Overview: Integrations with financial planning tools allow users to access their financial information in one central location, providing a holistic view of their financial situation.

- Improved Financial Planning: By integrating with financial planning tools, TurboTax Online users can better understand their financial goals and track their progress, making it easier to make informed decisions about their finances.

- Streamlined Tax Planning: Integrations with financial planning tools can help users understand how their tax decisions impact their overall financial picture, leading to more informed and strategic tax planning.

TurboTax Online Pros and Cons

TurboTax Online, like any other tax software, has its own set of advantages and disadvantages. Understanding these can help you make an informed decision about whether it’s the right choice for your tax preparation needs.

Advantages of TurboTax Online

TurboTax Online offers a number of advantages, making it a popular choice for many taxpayers.

- User-Friendly Interface: TurboTax Online is known for its intuitive and easy-to-use interface, making it suitable for taxpayers of all levels of experience, from beginners to those with complex tax situations.

- Comprehensive Coverage: TurboTax Online covers a wide range of tax situations, including deductions, credits, and forms, ensuring that you can file your taxes accurately and efficiently.

- Accurate Calculations: TurboTax Online uses advanced algorithms to calculate your taxes, minimizing the risk of errors and ensuring you get the maximum refund possible.

- Tax Advice and Support: TurboTax Online offers access to tax professionals who can answer your questions and provide guidance on complex tax situations.

- Mobile App: TurboTax Online offers a mobile app that allows you to track your tax progress, upload documents, and even file your taxes from your smartphone or tablet.

Disadvantages of TurboTax Online

While TurboTax Online offers many benefits, it also has some drawbacks that you should consider.

- Cost: TurboTax Online can be expensive, especially for those with complex tax situations or who need to file state returns.

- Limited Free Version: The free version of TurboTax Online is limited to simple tax situations, and you may need to upgrade to a paid version to access all features.

- Limited Customization: While TurboTax Online offers a variety of features, it may not be as customizable as some other tax software options, which could be a drawback for those with specific needs.

- Potential for Errors: Although TurboTax Online is generally accurate, there is always a risk of errors, especially if you make mistakes when entering your information.

Comparison with Competitors

TurboTax Online competes with other popular tax software options like H&R Block, TaxAct, and FreeTaxUSA. Each of these platforms has its own strengths and weaknesses, making it important to compare them based on your specific needs.

Key Differences:

– Pricing: TurboTax Online tends to be more expensive than some competitors, especially for premium features.

– Features: Each platform offers a different range of features, such as tax advice, audit support, and mobile app functionality.

– User Experience: The user interface and ease of use can vary significantly between platforms.

Potential Limitations of TurboTax Online

TurboTax Online, while a powerful tool, has certain limitations that could affect your tax filing experience.

- Limited Support for Complex Situations: TurboTax Online may not be suitable for all tax situations, such as those involving self-employment, rental properties, or business income.

- Dependence on Technology: TurboTax Online relies heavily on technology, and any technical issues or outages could disrupt your tax filing process.

- Privacy Concerns: As with any online service, there are concerns about the privacy of your personal and financial information.

TurboTax Online for Different Taxpayers

TurboTax Online is designed to cater to a wide range of taxpayers with varying tax situations and needs. The platform offers various features and tools tailored to different demographics and financial circumstances. Whether you’re self-employed, have investments, or are a student, TurboTax Online has options to help you file your taxes accurately and efficiently.

Taxpayers with Specific Tax Situations

TurboTax Online offers specialized features for taxpayers with unique tax situations, such as self-employment, investments, or dependents.

- Self-employed individuals: TurboTax Online provides comprehensive support for self-employed taxpayers, including guidance on deducting business expenses, reporting income from various sources, and calculating self-employment taxes. It also offers tools for tracking business expenses, generating invoices, and estimating quarterly tax payments.

- Investors: TurboTax Online helps investors navigate complex tax situations related to investments, such as capital gains and losses, dividends, and interest income. The platform offers guidance on reporting investment income and expenses, calculating tax liabilities, and maximizing deductions.

- Taxpayers with dependents: TurboTax Online assists taxpayers with dependents by providing guidance on claiming child tax credits, dependent care credits, and other applicable deductions. It also helps calculate the correct amount of child support payments and deductions for dependents.

TurboTax Online for Different Demographics

TurboTax Online is suitable for a wide range of demographics, including students, retirees, and families.

- Students: TurboTax Online offers a free version for students, which allows them to file simple tax returns without any cost. The platform provides guidance on claiming education credits and deductions, such as the American Opportunity Tax Credit and the Lifetime Learning Credit. It also helps students understand the tax implications of scholarships and grants.

- Retirees: TurboTax Online offers comprehensive support for retirees, including guidance on reporting retirement income, such as Social Security benefits, pensions, and 401(k) distributions. The platform helps retirees understand the tax implications of various retirement plans and offers tools for calculating retirement income and expenses. It also provides guidance on claiming deductions for medical expenses, property taxes, and other eligible expenses.

- Families: TurboTax Online provides features tailored to families, such as guidance on claiming child tax credits, dependent care credits, and other applicable deductions. The platform also helps families understand the tax implications of various family-related expenses, such as childcare costs and educational expenses. It offers tools for calculating family income and expenses and provides guidance on filing jointly or separately.

Features Relevant to Different Taxpayer Groups

The following table summarizes the features most relevant to each taxpayer group:

| Taxpayer Group | Relevant Features |

|---|---|

| Self-employed | Business expense tracking, invoice generation, self-employment tax calculation, quarterly tax payment estimation |

| Investors | Capital gains and losses reporting, dividend and interest income reporting, investment expense tracking |

| Taxpayers with dependents | Child tax credit calculation, dependent care credit calculation, child support deduction calculation |

| Students | Free filing for simple returns, education credit and deduction guidance, scholarship and grant tax implications |

| Retirees | Retirement income reporting, retirement plan tax implications, medical expense deduction guidance |

| Families | Child tax credit calculation, dependent care credit calculation, family income and expense calculation |

TurboTax Online Customer Reviews and Feedback

TurboTax Online is a popular tax preparation software, and customer reviews and feedback provide valuable insights into its strengths, weaknesses, and user experience. By analyzing user reviews from various platforms, we can gain a comprehensive understanding of what customers appreciate about TurboTax Online and what areas could be improved.

Common Themes and Sentiments

User reviews on TurboTax Online often reflect common themes and sentiments. Many users praise the software’s user-friendliness, intuitive interface, and comprehensive features. They appreciate the guidance provided throughout the tax preparation process, especially for those who are new to filing taxes or find it overwhelming. Customers also highlight the software’s accuracy and ability to maximize refunds. However, some users express frustration with technical issues, customer support, and pricing.

Recurring Issues and Complaints

- Technical Issues: Some users encounter technical glitches or errors during the tax preparation process, leading to delays and frustration. These issues may include website crashes, slow loading times, or difficulty accessing specific features.

- Customer Support: While many users find TurboTax Online’s customer support helpful, others report difficulties reaching support agents or experiencing long wait times. Some users also mention inconsistencies in the quality of support received.

- Pricing: The cost of TurboTax Online can be a concern for some users, especially those who are looking for a more budget-friendly option. Some users find the pricing structure confusing or feel that the software’s features do not justify the cost.

Insights from Customer Testimonials

Customer testimonials offer valuable insights into the real-life experiences of TurboTax Online users.

“I found TurboTax Online to be very user-friendly and easy to navigate. The step-by-step guidance made the process much less stressful, and I was confident that my taxes were being filed accurately.”

This testimonial highlights the software’s ease of use and its ability to provide users with confidence in their tax preparation.

“I was disappointed with the customer support I received. I had a technical issue that prevented me from completing my taxes, and it took me several hours to get in touch with a support agent. The agent was not able to resolve the issue, and I had to seek help elsewhere.”

This testimonial illustrates a negative experience with customer support, highlighting the potential challenges users may encounter when needing assistance.

“I’m happy with the features TurboTax Online offers, but I feel the pricing is a bit steep. I’m not sure if I’m getting the best value for my money, especially considering the availability of free alternatives.”

This testimonial reflects the concern some users have about the pricing of TurboTax Online, particularly in comparison to other options available in the market.

TurboTax Online Future Trends

TurboTax Online, a leader in the digital tax preparation space, is constantly evolving to meet the changing needs of taxpayers. As technology advances, we can expect to see significant developments and innovations in the platform, transforming the way individuals and businesses file their taxes.

The Impact of AI and Automation

The tax preparation industry is poised for significant disruption from emerging technologies like artificial intelligence (AI) and automation. TurboTax Online is already incorporating these technologies to streamline the tax filing process and enhance user experience.

- AI-powered chatbots and virtual assistants can provide personalized tax advice and answer user queries in real-time, offering a more efficient and convenient way to get support.

- Automated data extraction and analysis can help users gather and organize their tax information more efficiently, reducing the time and effort required for tax preparation.

- AI algorithms can analyze user data to identify potential deductions and credits, maximizing tax savings for individuals and businesses.

Personalized Tax Experiences

AI and machine learning will play a crucial role in creating personalized tax experiences for users. By analyzing user data and preferences, TurboTax Online can tailor its services to individual needs, offering customized guidance and recommendations.

- Personalized tax plans based on user income, expenses, and financial goals.

- Targeted advice and recommendations for deductions and credits based on user-specific circumstances.

- Proactive notifications and reminders about tax deadlines and relevant updates.

Integration with Financial Management Tools

The future of TurboTax Online lies in seamless integration with other financial management tools, creating a holistic financial ecosystem. Users will be able to access and manage their finances, including tax preparation, from a single platform.

- Integration with online banking platforms for automatic data transfer and reconciliation.

- Integration with investment and retirement accounts for accurate tax reporting.

- Integration with budgeting and expense tracking apps for streamlined tax preparation.

Enhanced Security and Privacy

As users rely more heavily on online tax preparation platforms, security and privacy will become paramount. TurboTax Online will need to invest in robust security measures to protect user data and maintain trust.

- Multi-factor authentication and encryption for secure data transmission.

- Regular security audits and updates to protect against cyber threats.

- Transparent data privacy policies and user controls for managing data access.

TurboTax Online’s Role in the Digital Tax Landscape

TurboTax Online is well-positioned to remain a dominant player in the digital tax landscape, leveraging its established brand, user base, and technological advancements. The platform will continue to innovate and adapt to the evolving needs of taxpayers, providing a comprehensive and user-friendly solution for tax preparation.

TurboTax Online Alternatives

TurboTax Online is a popular choice for tax preparation software, but it’s not the only option available. Several other reputable services offer competitive features and pricing, making it essential to explore your choices before making a decision.

Key Competitors to TurboTax Online

The tax preparation software market is competitive, with several key players vying for users’ attention. Some of the most prominent alternatives to TurboTax Online include:

- H&R Block Online: H&R Block is a well-established name in tax preparation, offering both in-person and online services. Their online platform provides a user-friendly interface, a wide range of features, and support for various tax situations.

- TaxAct: TaxAct is another popular online tax preparation service known for its affordability and comprehensive features. It caters to a wide range of taxpayers, from simple returns to complex situations.

- FreeTaxUSA: As the name suggests, FreeTaxUSA offers a free version for basic tax returns. However, it also provides paid versions with additional features and support for more complex tax situations.

- Credit Karma Tax: Credit Karma Tax is a free tax preparation service that aims to simplify the filing process. While it doesn’t offer as many features as some paid options, it’s a good choice for individuals with straightforward tax situations.

- TaxSlayer: TaxSlayer is a mid-priced tax preparation software known for its user-friendly interface and comprehensive features. It caters to both individual and business tax filers.

Comparing TurboTax Online with Alternatives

Each tax preparation software offers unique strengths and weaknesses, making it crucial to compare them based on your specific needs and preferences.

| Feature | TurboTax Online | H&R Block Online | TaxAct | FreeTaxUSA | Credit Karma Tax | TaxSlayer |

|---|---|---|---|---|---|---|

| Pricing | Ranges from free to premium tiers | Offers various pricing options | Affordable options, including a free version | Free for basic returns, paid for advanced features | Completely free for basic returns | Mid-priced options |

| Features | Comprehensive features, including state and federal tax filing, deductions, and credits | Wide range of features, including audit support and identity theft protection | Comprehensive features, including support for various tax situations | Basic features for simple returns, additional features in paid versions | Limited features, primarily for basic returns | Comprehensive features, including business tax filing |

| User Experience | Intuitive interface, guided steps, and helpful tips | User-friendly platform, with clear navigation and support | Easy-to-use interface, with straightforward steps | Simple and straightforward interface, suitable for basic returns | Simplified interface, designed for easy navigation | User-friendly platform, with clear instructions |

| Customer Support | Available through phone, email, and chat | Offers various support options, including phone, email, and live chat | Provides customer support through phone, email, and FAQs | Offers limited customer support through FAQs and email | Basic customer support through FAQs and online resources | Provides customer support through phone, email, and live chat |

Recommendations for Choosing the Best Tax Preparation Software

The best tax preparation software depends on your individual needs and circumstances. Consider the following factors when making your decision:

- Complexity of your tax situation: If you have a simple tax return, a free or basic version of a tax preparation software might suffice. However, if you have a complex tax situation, you may need a more comprehensive and feature-rich option.

- Budget: Tax preparation software prices vary widely, so consider your budget when making a decision. Free options are available, but paid versions offer additional features and support.

- User experience: Choose a software with a user-friendly interface that you find easy to navigate and understand. Look for guided steps, helpful tips, and clear instructions.

- Customer support: If you anticipate needing assistance with your tax return, choose a software that offers reliable customer support through phone, email, or live chat.

- Features: Consider the features offered by each software and ensure they meet your specific needs. For example, if you are self-employed, you may need software that supports business tax filing.

Wrap-Up

With its comprehensive features, user-friendly design, and robust security measures, TurboTax Online empowers individuals to take control of their tax preparation process. By simplifying the tax filing experience, TurboTax Online helps users navigate the complexities of tax law and ensure accurate and timely submissions.

TurboTax Online simplifies your tax filing process, but managing your clients can be a whole other ball game. For that, you might want to look into a sales CRM to help you keep track of leads, appointments, and follow-ups.

Once you’ve mastered your tax filing and client management, you can focus on growing your business and taking on new challenges.