QuickBooks Download: It’s the key to unlocking streamlined business operations. Whether you’re a seasoned entrepreneur or just starting out, QuickBooks offers a comprehensive suite of tools designed to simplify financial management, automate tasks, and boost productivity.

Table of Contents

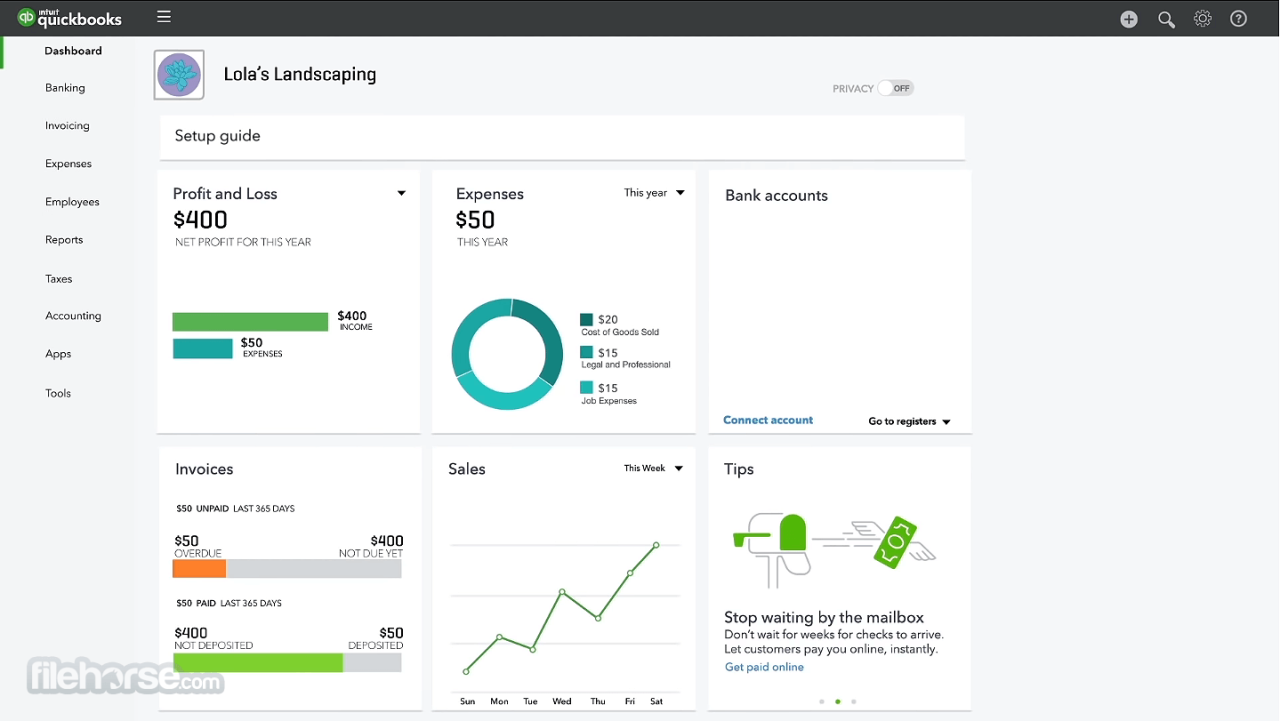

From managing invoices and tracking expenses to analyzing financial performance and generating reports, QuickBooks empowers businesses of all sizes to stay organized, efficient, and profitable.

QuickBooks Download

QuickBooks is a popular accounting software used by businesses of all sizes to manage their finances. Downloading QuickBooks allows you to install the software on your computer and access its features offline.

Downloading QuickBooks is a straightforward process that can be completed in a few simple steps. Once you have downloaded the software, you can install it on your computer and begin using it to manage your business finances.

Downloading QuickBooks is a breeze, and once you’re set up, you can easily manage your finances. If you need to create professional-looking invoices or reports, consider using a powerful editing tool like adobe editor. With its advanced features, you can create visually appealing documents that enhance your QuickBooks data.

After you’ve finished editing, you can seamlessly integrate the documents back into your QuickBooks workflow, making your financial management even smoother.

Versions of QuickBooks

QuickBooks offers a variety of versions to cater to the needs of different businesses. Here are some of the most popular versions available for download:

- QuickBooks Self-Employed: Designed for freelancers and independent contractors, this version provides basic accounting features, invoicing, and expense tracking.

- QuickBooks Online: This cloud-based version allows you to access your financial data from anywhere with an internet connection. It offers features such as online banking integration, automated bill pay, and real-time reporting.

- QuickBooks Desktop: This traditional version is installed on your computer and provides a comprehensive suite of accounting features, including inventory management, payroll, and reporting.

- QuickBooks Pro: This version is designed for small businesses and offers features such as invoicing, expense tracking, and financial reporting.

- QuickBooks Premier: This version is suitable for mid-sized businesses and offers advanced features such as inventory management, job costing, and industry-specific tools.

- QuickBooks Enterprise: This version is designed for large businesses and offers the most comprehensive set of features, including advanced reporting, multi-user access, and customization options.

Benefits of Using QuickBooks

There are numerous benefits to using QuickBooks for business management. Here are some of the key advantages:

- Improved Accuracy: QuickBooks helps to ensure accurate financial records by automating tasks such as invoicing, expense tracking, and bank reconciliation.

- Enhanced Efficiency: QuickBooks streamlines financial processes, saving you time and effort by automating tasks and providing easy access to financial data.

- Better Financial Insights: QuickBooks provides comprehensive reports and dashboards that offer valuable insights into your business finances, allowing you to make informed decisions.

- Simplified Tax Preparation: QuickBooks simplifies tax preparation by providing easy access to financial data and generating reports that meet tax requirements.

- Increased Productivity: By automating tasks and providing a centralized platform for managing finances, QuickBooks frees up your time to focus on other aspects of your business.

Downloading QuickBooks: Quickbooks Download

Downloading QuickBooks is the first step in utilizing this powerful accounting software. You can choose from several options, each tailored to your specific needs and preferences.

Downloading QuickBooks Desktop, Quickbooks download

The QuickBooks Desktop version is a traditional software program that you install on your computer. This option provides you with a robust set of features and allows you to work offline.

Here are the steps for downloading QuickBooks Desktop:

- Visit the Intuit website, the company behind QuickBooks.

- Navigate to the “QuickBooks Desktop” section.

- Select the specific version of QuickBooks Desktop that you want to download, such as QuickBooks Pro, Premier, or Enterprise.

- Click on the “Download” button.

- Follow the on-screen instructions to complete the download and installation process.

Downloading QuickBooks Online

QuickBooks Online is a cloud-based accounting software that you access through your web browser. This option is ideal for businesses that require flexibility and remote access.

Here are the steps for downloading QuickBooks Online:

- Visit the Intuit website.

- Navigate to the “QuickBooks Online” section.

- Select the specific version of QuickBooks Online that you want to use, such as Simple Start, Essentials, or Plus.

- Click on the “Start Free Trial” or “Sign Up” button.

- Create a new account and follow the on-screen instructions to complete the signup process.

System Requirements for Downloading QuickBooks

To ensure a smooth download and installation process, your computer needs to meet the minimum system requirements for QuickBooks. These requirements vary depending on the version of QuickBooks you choose.

Here are some general system requirements for QuickBooks:

- Operating system: Windows 10 or later, macOS 10.15 or later

- Processor: Intel Core i3 or equivalent

- RAM: 4 GB or more

- Hard disk space: 2 GB or more

- Internet connection: Required for QuickBooks Online and for some features of QuickBooks Desktop.

QuickBooks Installation and Setup

Installing and setting up QuickBooks is a straightforward process that allows you to begin managing your business finances effectively. This guide will provide detailed instructions on how to install and configure QuickBooks for your specific business needs.

Installing QuickBooks

After downloading QuickBooks, you can begin the installation process.

- Double-click the downloaded QuickBooks file to initiate the installation.

- Follow the on-screen instructions to proceed with the installation.

- Select the desired installation options, such as the language and installation location.

- Wait for the installation to complete. This may take a few minutes depending on your system’s specifications.

Configuring QuickBooks

Once QuickBooks is installed, you need to configure it to meet your business requirements.

- Create a new company file: This will be your primary file for managing your business data.

- Enter your company information, including your business name, address, and contact details.

- Choose your industry: This will help QuickBooks customize features and reports relevant to your business.

- Set up your chart of accounts: This is a list of all the financial accounts your business uses, such as assets, liabilities, equity, revenue, and expenses.

- Configure your preferences: Customize QuickBooks settings according to your preferences, such as the date format, currency, and decimal places.

Common QuickBooks Setup Tasks

| Task | Steps |

|---|---|

| Setting up customers and vendors |

|

| Creating invoices and sales receipts |

|

| Tracking expenses and payments |

|

| Reconciling bank accounts |

|

QuickBooks Features and Functionality

QuickBooks is a popular accounting software designed for small and medium-sized businesses. It offers a wide range of features to manage various aspects of a business, from finances and inventory to payroll and customer relationships. This section delves into some of QuickBooks’ key features and their functionalities, showcasing how they can streamline business processes.

Invoicing

Invoicing is a crucial aspect of any business, and QuickBooks provides robust tools to simplify this process. Users can easily create professional-looking invoices with customized templates, track payments, and manage outstanding balances.

- Invoice Creation: QuickBooks allows you to create invoices quickly and easily. You can add items, customize invoice templates, and track payment status.

- Payment Tracking: QuickBooks automatically tracks payments received and outstanding balances. This helps businesses stay organized and manage cash flow effectively.

- Online Payments: QuickBooks integrates with online payment processors like PayPal and Stripe, enabling customers to pay invoices directly through the software.

Payroll

Managing payroll efficiently is essential for any business. QuickBooks Payroll simplifies this process by automating tasks such as calculating wages, withholding taxes, and generating paychecks.

- Payroll Calculation: QuickBooks Payroll automatically calculates wages, deductions, and taxes based on employee information and tax laws.

- Direct Deposit: QuickBooks Payroll allows businesses to set up direct deposit for employees, eliminating the need for physical checks.

- Tax Filing: QuickBooks Payroll can help businesses file payroll taxes electronically, reducing the risk of errors and penalties.

Inventory Management

For businesses that sell products, inventory management is critical for tracking stock levels, managing orders, and optimizing supply chains. QuickBooks provides features to streamline inventory processes.

- Inventory Tracking: QuickBooks allows businesses to track inventory levels, costs, and sales history. This information can be used to make informed decisions about purchasing and pricing.

- Purchase Orders: QuickBooks enables businesses to create purchase orders for suppliers, track orders, and manage inventory receipts.

- Sales Orders: QuickBooks can be used to create sales orders, track order fulfillment, and manage customer orders.

Reporting

QuickBooks offers a wide range of reports that provide insights into business performance. These reports can help businesses track revenue, expenses, profitability, and other key metrics.

- Financial Reports: QuickBooks provides standard financial reports such as balance sheets, income statements, and cash flow statements.

- Custom Reports: Businesses can create custom reports to track specific data points relevant to their needs.

- Reporting Tools: QuickBooks offers various reporting tools to analyze data, create charts and graphs, and present information in a user-friendly format.

Customer Relationship Management (CRM)

QuickBooks provides basic CRM features to help businesses manage customer interactions and track sales opportunities.

- Customer Database: QuickBooks allows businesses to store customer information, including contact details, purchase history, and notes.

- Sales Tracking: QuickBooks enables businesses to track sales opportunities, manage leads, and monitor customer interactions.

- Marketing Tools: QuickBooks includes basic marketing tools to send emails and track marketing campaigns.

QuickBooks Support and Resources

QuickBooks offers a comprehensive range of support options to assist users in navigating the software and resolving any issues they may encounter. This includes a variety of resources for learning how to use QuickBooks effectively.

Support Options

QuickBooks provides several support options to cater to the diverse needs of its users. These options include:

- Phone Support: Users can connect with QuickBooks customer service representatives over the phone for immediate assistance with their inquiries.

- Live Chat: QuickBooks offers a live chat option for users who prefer a more interactive and real-time support experience.

- Email Support: Users can submit their inquiries or issues via email, allowing them to receive a detailed response from QuickBooks support staff.

- Community Forums: QuickBooks maintains active community forums where users can connect with fellow QuickBooks users, share knowledge, and seek solutions to common problems.

- Online Help Center: QuickBooks provides a comprehensive online help center that houses a vast library of articles, FAQs, and tutorials covering a wide range of topics related to the software.

Learning Resources

QuickBooks offers a variety of learning resources to empower users to master the software and maximize its potential. These resources include:

- QuickBooks Tutorials: QuickBooks provides a wide array of tutorials covering various aspects of the software, from basic functionalities to advanced features. These tutorials are designed to be easy to follow and provide step-by-step guidance for users of all skill levels.

- QuickBooks Training Courses: QuickBooks offers a variety of training courses that delve deeper into specific aspects of the software. These courses can be taken online or in person and are led by experienced QuickBooks instructors.

- QuickBooks Certification: QuickBooks offers certification programs for individuals seeking to demonstrate their proficiency in using the software. Certification can enhance career prospects and provide a competitive edge in the job market.

QuickBooks Support Resources

| Resource | Contact Information |

|---|---|

| Phone Support | 1-800-446-8848 |

| Live Chat | Available on the QuickBooks website |

| Email Support | [email protected] |

| Community Forums | https://community.intuit.com/ |

| Online Help Center | https://quickbooks.intuit.com/support/ |

QuickBooks Integration with Other Software

QuickBooks is a powerful accounting software that can be integrated with a variety of other business applications. This integration allows businesses to streamline their operations, automate tasks, and improve efficiency.

Benefits of QuickBooks Integration

Integrating QuickBooks with other software can bring numerous benefits to businesses, including:

- Improved Data Accuracy: By integrating QuickBooks with other software, businesses can ensure that data is synchronized across all platforms, reducing the risk of errors and inconsistencies. This leads to more accurate financial reporting and decision-making.

- Increased Efficiency: Integration allows businesses to automate tasks, such as generating invoices, tracking expenses, and reconciling bank statements. This frees up time for staff to focus on more strategic activities.

- Enhanced Collaboration: QuickBooks integration enables seamless data sharing between different departments, improving communication and collaboration within the organization. For example, sales teams can access real-time inventory data from QuickBooks, ensuring accurate order fulfillment.

- Streamlined Workflow: By integrating QuickBooks with other software, businesses can create a more streamlined workflow, reducing the need for manual data entry and minimizing the risk of human error.

Examples of Popular QuickBooks Integrations

There are many popular software solutions that can be integrated with QuickBooks. Some of the most common integrations include:

- CRM (Customer Relationship Management) Software: Integrating QuickBooks with CRM software like Salesforce or HubSpot allows businesses to track customer interactions, manage sales pipelines, and generate invoices directly from the CRM platform. This streamlines the sales process and provides a complete view of customer interactions.

- E-commerce Platforms: Integrating QuickBooks with e-commerce platforms such as Shopify or WooCommerce enables businesses to automatically sync sales data, manage inventory levels, and generate invoices for online orders. This simplifies the process of managing online sales and reduces the risk of errors.

- Payment Gateways: QuickBooks integration with payment gateways like Stripe or PayPal allows businesses to accept payments online, reconcile transactions, and track revenue streams. This simplifies the process of managing online payments and reduces the risk of fraud.

- Project Management Software: Integrating QuickBooks with project management software like Asana or Trello allows businesses to track project costs, allocate resources, and generate invoices for project-based work. This improves project management efficiency and provides a clear overview of project profitability.

QuickBooks for Different Industries

QuickBooks is a versatile accounting software that caters to the diverse needs of various industries. Its customizable features and functionalities allow businesses across different sectors to streamline their financial operations and gain valuable insights.

Retail

Retail businesses face unique challenges, such as managing inventory, tracking sales, and handling customer returns. QuickBooks offers a range of features specifically designed to address these needs.

- Inventory Management: QuickBooks provides tools for tracking inventory levels, managing purchase orders, and automating reorder points. This helps retailers optimize their inventory and reduce stockouts or overstocking.

- Point of Sale (POS): QuickBooks integrates with POS systems, allowing retailers to process transactions, track sales data, and manage customer information seamlessly.

- Customer Relationship Management (CRM): QuickBooks’ CRM features enable retailers to build customer loyalty programs, track customer interactions, and personalize marketing campaigns.

Case Study:

A clothing boutique using QuickBooks to manage its inventory and track sales experienced a 15% increase in sales within a year. The software’s inventory management features allowed them to optimize stock levels, reducing waste and maximizing profitability.

Manufacturing

Manufacturing companies require robust accounting systems to manage production costs, track inventory, and monitor profitability. QuickBooks offers features that streamline manufacturing processes.

- Bill of Materials (BOM): QuickBooks allows manufacturers to create BOMs, which define the components and quantities required for each product. This ensures accurate cost calculations and efficient production planning.

- Work Order Management: QuickBooks provides tools for managing work orders, tracking production progress, and monitoring labor costs. This helps manufacturers optimize production efficiency and reduce downtime.

- Cost Accounting: QuickBooks’ cost accounting features enable manufacturers to track direct and indirect costs associated with production, allowing them to identify areas for cost reduction and improve profitability.

Case Study:

A small-scale furniture manufacturer implemented QuickBooks to manage its production processes. By tracking inventory levels and production costs, the company identified inefficiencies in its supply chain, leading to a 10% reduction in manufacturing costs.

Service

Service businesses often face challenges in managing customer appointments, tracking service hours, and generating invoices. QuickBooks offers features tailored to address these needs.

- Appointment Scheduling: QuickBooks allows service businesses to schedule appointments, manage customer calendars, and send appointment reminders. This helps optimize service delivery and reduce missed appointments.

- Time Tracking: QuickBooks’ time tracking features enable service providers to record the time spent on each project or task, facilitating accurate billing and profitability analysis.

- Service Invoicing: QuickBooks simplifies the invoicing process for service businesses, allowing them to create customized invoices and track payments efficiently.

Case Study:

A landscaping company using QuickBooks for appointment scheduling and time tracking improved its customer satisfaction by reducing missed appointments and providing accurate billing.

QuickBooks Security and Data Protection

QuickBooks is a powerful financial management software that can be used to manage your business finances. However, it’s essential to understand the security measures implemented in QuickBooks and how to protect your data from unauthorized access. This section will provide an overview of QuickBooks security features, tips for safeguarding your data, and best practices for maintaining a secure QuickBooks environment.

QuickBooks Security Features

QuickBooks incorporates various security features to protect your data. These features are designed to prevent unauthorized access, maintain data integrity, and ensure the security of your financial information.

- Password Protection: QuickBooks requires a password to access the software. This ensures that only authorized users can access your financial data. Strong passwords, combining uppercase and lowercase letters, numbers, and special characters, are recommended for enhanced security.

- User Roles and Permissions: QuickBooks allows you to assign different roles and permissions to users. This enables you to control which users have access to specific features and data within the software. For instance, you can create separate user accounts for employees, contractors, or external accountants, granting them access to only the information they need to perform their duties.

- Data Encryption: QuickBooks uses encryption to protect your data while it’s being transmitted and stored. Encryption converts data into an unreadable format, making it difficult for unauthorized individuals to access or understand.

- Two-Factor Authentication (2FA): QuickBooks offers 2FA, which adds an extra layer of security to your account. When you enable 2FA, you’ll need to enter a code generated by your mobile device or email in addition to your password to access your QuickBooks account. This makes it much harder for unauthorized individuals to access your data, even if they know your password.

Protecting QuickBooks Data

Protecting your QuickBooks data requires a multi-faceted approach. Here are some key steps to ensure the security of your financial information:

- Regularly Update QuickBooks: QuickBooks releases regular updates to address security vulnerabilities and improve the software’s performance. It’s crucial to install these updates promptly to ensure your software is protected against the latest threats.

- Use Strong Passwords: As mentioned earlier, strong passwords are crucial for protecting your QuickBooks account. Avoid using easily guessable passwords and consider using a password manager to store and manage your passwords securely.

- Enable Two-Factor Authentication: Two-factor authentication adds an extra layer of security and is highly recommended for all QuickBooks users. This feature significantly reduces the risk of unauthorized access to your account, even if someone has your password.

- Limit User Access: Assign roles and permissions to users based on their job responsibilities. This ensures that only authorized individuals have access to sensitive financial information.

- Backup Your Data Regularly: Regular backups are essential for protecting your QuickBooks data against data loss due to hardware failure, software issues, or malicious attacks. Implement a robust backup strategy that includes both local and off-site backups.

- Use a Secure Network: Ensure your computer and network are secure by using strong passwords, installing anti-virus software, and regularly updating your operating system and security software.

- Be Aware of Phishing Scams: Be cautious of phishing emails or phone calls that attempt to trick you into revealing your QuickBooks login credentials. Never share your password or other sensitive information with anyone you don’t trust.

Maintaining QuickBooks Security

Maintaining a secure QuickBooks environment requires ongoing vigilance and proactive measures. Here are some tips to help you keep your QuickBooks data safe:

- Regularly Review User Permissions: Periodically review user permissions and ensure they are still appropriate. Remove access for users who no longer need it and update permissions as job roles change.

- Monitor QuickBooks Activity: Regularly review QuickBooks activity logs to identify any unusual or suspicious activity. This can help you detect and address security breaches early on.

- Stay Informed About Security Threats: Stay updated on the latest security threats and vulnerabilities that could affect QuickBooks. This information can help you take proactive steps to protect your data.

- Use a Security Audit: Consider conducting regular security audits to identify and address any security vulnerabilities in your QuickBooks environment. This can help you ensure your data is adequately protected.

QuickBooks Pricing and Subscription Options

QuickBooks offers various pricing plans designed to cater to the needs of different businesses. Each plan comes with a unique set of features and functionalities, making it crucial to choose the right plan for your specific business requirements. This section will delve into the different QuickBooks pricing plans, highlight the features included in each option, and provide a comprehensive comparison to help you make an informed decision.

QuickBooks Online Pricing Plans

QuickBooks Online offers four main pricing plans: Simple Start, Essentials, Plus, and Advanced. These plans are designed to cater to businesses of varying sizes and complexities, offering a range of features to manage finances, track inventory, and generate reports.

- Simple Start: This plan is ideal for small businesses with basic accounting needs. It includes features such as invoicing, expense tracking, bank reconciliation, and basic reporting. It’s a good starting point for entrepreneurs or businesses just beginning to track their finances.

- Essentials: This plan builds upon the Simple Start plan by adding features like inventory management, project tracking, and more detailed reporting. It’s suitable for businesses that need to track inventory or manage multiple projects.

- Plus: This plan offers additional features such as advanced reporting, custom fields, and the ability to manage multiple locations. It’s a good option for businesses that require more complex reporting or have multiple locations.

- Advanced: This plan is designed for businesses with complex accounting needs. It includes all the features of the Plus plan, plus advanced features like job costing, budgeting, and time tracking. It’s ideal for businesses with multiple departments or that require more in-depth financial analysis.

QuickBooks Self-Employed Pricing Plan

QuickBooks Self-Employed is a simplified accounting solution designed specifically for freelancers and independent contractors. It offers a streamlined approach to managing finances, including expense tracking, mileage tracking, and income and expense reporting.

- QuickBooks Self-Employed: This plan is ideal for freelancers and independent contractors who need a simple and affordable way to track their income and expenses. It offers features such as mileage tracking, expense categorization, and income and expense reporting. It’s a good option for those who want to stay organized and file taxes with ease.

Comparison of QuickBooks Pricing Plans

The following table provides a comprehensive comparison of the different QuickBooks Online and Self-Employed pricing plans, highlighting the key features included in each:

| Feature | Simple Start | Essentials | Plus | Advanced | Self-Employed |

|---|---|---|---|---|---|

| Invoicing | Yes | Yes | Yes | Yes | Yes |

| Expense Tracking | Yes | Yes | Yes | Yes | Yes |

| Bank Reconciliation | Yes | Yes | Yes | Yes | Yes |

| Inventory Management | No | Yes | Yes | Yes | No |

| Project Tracking | No | Yes | Yes | Yes | No |

| Reporting | Basic | Detailed | Advanced | Advanced | Basic |

| Custom Fields | No | Yes | Yes | Yes | No |

| Multiple Locations | No | No | Yes | Yes | No |

| Job Costing | No | No | No | Yes | No |

| Budgeting | No | No | No | Yes | No |

| Time Tracking | No | No | No | Yes | No |

| Mileage Tracking | No | No | No | No | Yes |

| Price (Monthly) | $25 | $45 | $80 | $180 | $15 |

Note: Prices may vary depending on the number of users and the specific features included in each plan. It’s recommended to visit the QuickBooks website for the most up-to-date pricing information.

Concluding Remarks

Navigating the world of QuickBooks download can feel overwhelming, but with the right guidance and resources, you can confidently harness its power to achieve your business goals. From choosing the right version to integrating with other software, this guide provides a roadmap to seamless QuickBooks adoption.