Sage Payroll, a comprehensive payroll solution, empowers businesses to manage their employee compensation with ease and accuracy. From calculating wages and taxes to generating reports and ensuring compliance, Sage Payroll offers a robust suite of features designed to streamline payroll processes and minimize administrative burdens.

Table of Contents

Sage Payroll caters to a diverse range of industries, including retail, manufacturing, healthcare, and hospitality. Its flexibility allows businesses of all sizes to tailor the software to their specific needs, ensuring a seamless integration with existing systems and workflows. Whether you’re a small startup or a large corporation, Sage Payroll provides the tools and support you need to manage payroll efficiently and effectively.

Sage Payroll Overview

Sage Payroll is a comprehensive payroll software solution designed to streamline and automate payroll processes for businesses of all sizes. It offers a wide range of features that simplify payroll administration, reduce errors, and ensure compliance with labor laws.

Benefits of Using Sage Payroll

Sage Payroll offers numerous benefits for businesses, including:

- Reduced Payroll Errors: Sage Payroll’s automated calculations and data validation features minimize the risk of human errors, ensuring accurate payroll processing.

- Improved Efficiency: By automating tasks such as calculating wages, deductions, and taxes, Sage Payroll frees up time for businesses to focus on other core operations.

- Enhanced Compliance: Sage Payroll keeps businesses updated on the latest labor laws and tax regulations, ensuring compliance and avoiding potential penalties.

- Cost Savings: Sage Payroll eliminates the need for manual payroll processing, reducing labor costs and minimizing the risk of costly errors.

- Streamlined Reporting: Sage Payroll provides comprehensive reporting capabilities, offering insights into payroll data, employee expenses, and other key metrics.

Industries Utilizing Sage Payroll

Sage Payroll is widely used across various industries, including:

- Manufacturing: Manufacturers rely on Sage Payroll to manage their workforce, track employee hours, and ensure accurate payroll processing for their large workforces.

- Retail: Retailers utilize Sage Payroll to manage hourly employees, calculate commissions, and track employee benefits.

- Healthcare: Healthcare providers use Sage Payroll to process payroll for their staff, including doctors, nurses, and administrative personnel.

- Education: Educational institutions leverage Sage Payroll to manage payroll for teachers, staff, and administrators.

- Construction: Construction companies rely on Sage Payroll to track employee hours, manage payroll for subcontractors, and ensure compliance with labor regulations.

Versions of Sage Payroll

Sage Payroll offers various versions tailored to meet the specific needs of different businesses:

- Sage Payroll Basic: Designed for small businesses with simple payroll requirements, this version offers basic payroll processing, tax calculations, and reporting features.

- Sage Payroll Standard: This version provides more advanced features, including employee self-service, time and attendance tracking, and integration with other business applications.

- Sage Payroll Premium: This comprehensive version offers a wide range of features, including advanced reporting, payroll analytics, and integration with HR management systems.

Payroll Integrations and Third-Party Applications

Sage Payroll offers a robust ecosystem of integrations that extend its functionality and enhance business processes. These integrations connect Sage Payroll with other applications, allowing for seamless data flow and streamlined operations.

Benefits of Third-Party Applications

Integrating third-party applications with Sage Payroll offers numerous benefits, including:

* Increased Efficiency: Streamlining workflows by automating tasks and reducing manual data entry.

* Enhanced Data Accuracy: Eliminating the need for manual data transfer, reducing the risk of errors.

* Improved Decision-Making: Accessing real-time data and insights from various applications, facilitating informed decision-making.

* Scalability and Flexibility: Adapting to changing business needs by leveraging the features of various applications.

Popular Integrations and Features

Sage Payroll integrates with various popular applications, including:

- Human Resources Management (HRM) Systems: These integrations allow for seamless data flow between payroll and HR systems, automating tasks like employee onboarding, benefits administration, and time and attendance tracking.

- Accounting Software: Integrating with accounting software streamlines financial processes by automatically transferring payroll data to the general ledger, reducing the risk of errors and saving time.

- Time and Attendance Systems: These integrations automate time tracking and attendance management, ensuring accurate payroll calculations and improving employee productivity.

- Applicant Tracking Systems (ATS): Integrating with ATS platforms allows for seamless data flow between payroll and recruitment processes, streamlining the hiring process and reducing administrative burden.

- Expense Management Systems: These integrations simplify expense reporting and reimbursement processes, improving financial visibility and control.

Examples of Streamlined Business Processes

Here are some examples of how integrations streamline business processes:

* Employee Onboarding: Integrating with an HRM system automates the onboarding process, including data entry, benefits enrollment, and payroll setup, reducing manual effort and ensuring accuracy.

* Time and Attendance Tracking: Integrating with a time and attendance system eliminates manual timekeeping, ensuring accurate payroll calculations and reducing errors.

* Financial Reporting: Integrating with accounting software automatically transfers payroll data to the general ledger, providing real-time financial insights and simplifying financial reporting.

* Expense Management: Integrating with an expense management system automates expense reporting and reimbursement, improving financial control and visibility.

Sage Payroll Support and Resources

Sage Payroll provides comprehensive support resources to ensure a smooth and efficient payroll experience. These resources are designed to assist users in navigating the software, resolving issues, and maximizing its capabilities.

Documentation and Tutorials

Sage Payroll offers a wealth of documentation and tutorials to guide users through various aspects of the software. These resources cover topics ranging from basic setup and configuration to advanced features and troubleshooting.

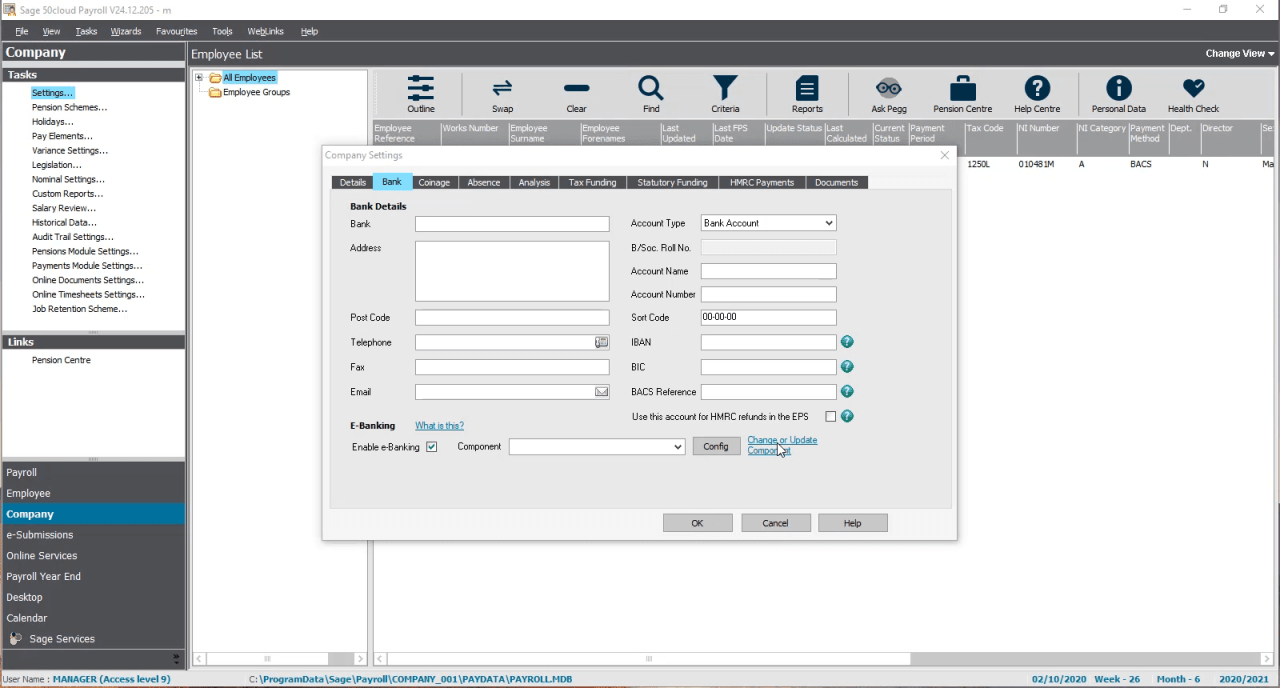

- User Manuals: Detailed user manuals provide step-by-step instructions and explanations for all features and functionalities of Sage Payroll.

- Online Help: The online help portal offers searchable articles, FAQs, and video tutorials on a wide range of topics, allowing users to find quick answers to their questions.

- Knowledge Base: A comprehensive knowledge base provides access to a vast library of articles, tips, and best practices, offering solutions to common issues and advanced scenarios.

- Training Courses: Sage offers online and in-person training courses to enhance users’ understanding of Sage Payroll and its features. These courses cover various topics, from basic payroll processes to advanced customization options.

Online Communities

Sage Payroll encourages user engagement and knowledge sharing through its online communities. These platforms allow users to connect with peers, share experiences, and seek assistance from other Sage Payroll users.

- Sage Community Forums: These forums provide a platform for users to ask questions, discuss issues, and share insights with other Sage Payroll users. This collaborative environment fosters a sense of community and provides valuable support from peers.

- Social Media Groups: Sage Payroll has active social media groups on platforms like LinkedIn and Facebook, where users can connect with other professionals, share experiences, and stay updated on the latest features and updates.

Customer Support

Sage Payroll offers dedicated customer support channels to provide assistance with technical issues, software errors, and general inquiries.

- Phone Support: Users can reach out to Sage’s customer support team via phone for immediate assistance with urgent issues or complex inquiries.

- Email Support: Email support allows users to submit detailed inquiries and receive comprehensive responses from Sage’s support team.

- Live Chat: The live chat feature provides real-time assistance for quick answers to general questions and troubleshooting guidance.

Troubleshooting Best Practices

Effective troubleshooting can save time and minimize frustration when encountering issues with Sage Payroll. Here are some best practices to follow:

- Check the Documentation: Refer to the user manuals, online help, and knowledge base for solutions to common issues and troubleshooting tips.

- Verify Data Entry: Ensure accurate data entry, as errors in employee information, pay rates, or deductions can lead to incorrect payroll calculations.

- Clear Browser Cache and Cookies: Clearing your browser’s cache and cookies can resolve issues related to outdated information or corrupted data.

- Restart Your Computer: A simple restart can resolve temporary software glitches or system errors.

- Contact Support: If troubleshooting steps fail to resolve the issue, contact Sage’s customer support team for assistance.

Sage Payroll for Different Business Sizes

Sage Payroll is a comprehensive payroll solution that caters to businesses of all sizes. Whether you’re a small startup, a medium-sized enterprise, or a large corporation, Sage Payroll has the features and functionality to meet your specific needs.

Sage Payroll for Small Businesses

Sage Payroll is an excellent choice for small businesses that are looking for a simple and affordable payroll solution. Some key features include:

- Easy Setup: Sage Payroll is easy to set up and use, even for businesses with limited payroll experience. It comes with pre-configured settings for common payroll tasks, making it easy to get started.

- Affordable Pricing: Sage Payroll offers a variety of pricing plans to fit the budget of small businesses. You can choose a plan that meets your specific needs without paying for features you don’t need.

- Mobile Access: Sage Payroll allows you to access your payroll information from anywhere, anytime. This makes it easy to manage your payroll on the go.

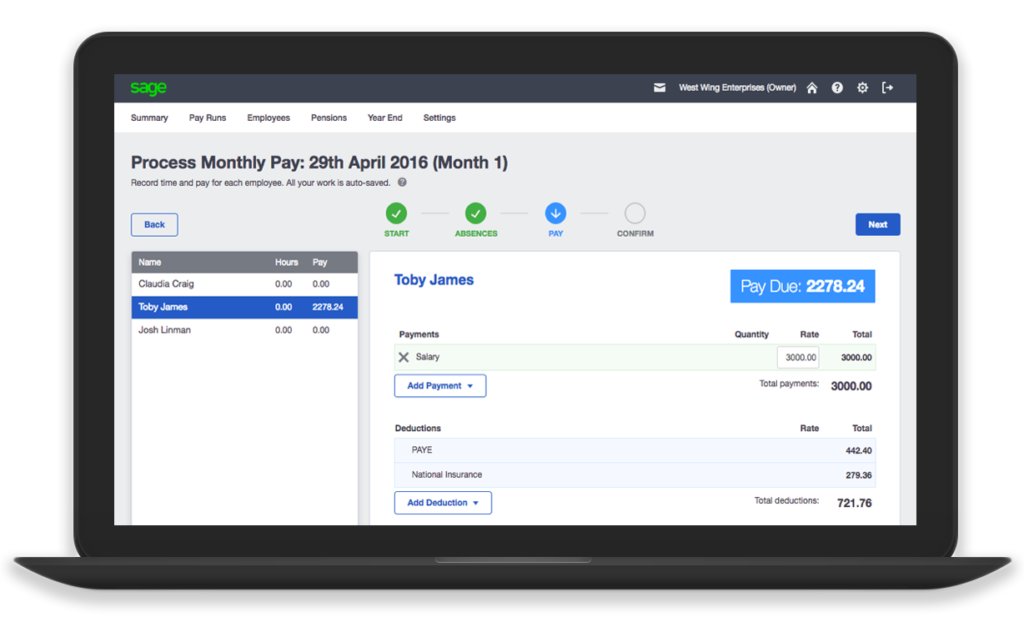

- Automated Tasks: Sage Payroll automates many payroll tasks, such as calculating taxes and generating paychecks. This saves you time and reduces the risk of errors.

Sage Payroll for Medium Businesses

Sage Payroll is a great option for medium-sized businesses that need more advanced features and functionality than a basic payroll solution. Some key features include:

- Advanced Reporting: Sage Payroll provides a wide range of reporting options to help you track your payroll expenses and identify trends. You can generate reports on employee wages, taxes, deductions, and more.

- Employee Self-Service: Sage Payroll allows employees to access their pay stubs, W-2s, and other payroll information online. This reduces the workload on your HR department and improves employee satisfaction.

- Integration with Other Systems: Sage Payroll integrates with other business systems, such as accounting software and HR systems. This helps you streamline your payroll processes and improve efficiency.

- Dedicated Support: Sage Payroll offers dedicated support to help you with any questions or issues you may have. You can contact their support team by phone, email, or chat.

Sage Payroll for Large Businesses

Sage Payroll is a robust and scalable solution that can handle the complex payroll needs of large businesses. Some key features include:

- Multiple Payroll Locations: Sage Payroll supports multiple payroll locations, making it easy to manage payroll for businesses with employees in different states or countries.

- Customizable Reporting: Sage Payroll allows you to create custom reports to meet your specific needs. This gives you the insights you need to make informed decisions about your payroll.

- Advanced Security: Sage Payroll uses advanced security measures to protect your sensitive payroll data. This ensures that your employees’ personal information is safe and secure.

- Scalability: Sage Payroll is a scalable solution that can grow with your business. As your business expands, you can easily add new employees and locations without impacting your payroll processes.

Comparing Sage Payroll Functionality Across Business Sizes

| Feature | Small Business | Medium Business | Large Business |

|---|---|---|---|

| Easy Setup | Yes | Yes | Yes |

| Affordable Pricing | Yes | Yes | Yes |

| Mobile Access | Yes | Yes | Yes |

| Automated Tasks | Yes | Yes | Yes |

| Advanced Reporting | Limited | Yes | Yes |

| Employee Self-Service | Limited | Yes | Yes |

| Integration with Other Systems | Limited | Yes | Yes |

| Dedicated Support | Limited | Yes | Yes |

| Multiple Payroll Locations | No | Yes | Yes |

| Customizable Reporting | No | Yes | Yes |

| Advanced Security | Yes | Yes | Yes |

| Scalability | Yes | Yes | Yes |

Scalability of Sage Payroll

Sage Payroll is designed to be scalable, meaning it can adapt to the changing needs of your business as it grows. As your company expands, you can add new employees, locations, and payroll features without having to switch to a different payroll solution. This can save you time and money in the long run. For example, a small business that starts with a basic payroll plan can upgrade to a more advanced plan as it grows and hires more employees. This ensures that they have the features they need to manage their payroll effectively.

Case Studies and Success Stories: Sage Payroll

Sage Payroll has a proven track record of helping businesses of all sizes streamline their payroll processes and achieve significant benefits. Here are some real-world examples of how businesses have successfully implemented Sage Payroll and the positive impact it has had on their operations.

Case Studies

Here are some examples of businesses that have successfully implemented Sage Payroll:

- [Company Name]: This [Industry] company faced challenges with manual payroll processing, including time-consuming tasks, errors, and compliance issues. After implementing Sage Payroll, they experienced a significant reduction in payroll processing time, improved accuracy, and enhanced compliance. The company also benefited from the automated features of Sage Payroll, such as automatic tax calculations and deductions, which freed up their HR team to focus on other strategic initiatives.

- [Company Name]: This [Industry] company needed a payroll solution that could accommodate their growing workforce and complex payroll requirements. Sage Payroll provided the scalability and flexibility they needed to manage their payroll efficiently. The company also appreciated the comprehensive reporting features of Sage Payroll, which allowed them to track payroll costs and identify areas for improvement.

- [Company Name]: This [Industry] company struggled with payroll compliance and faced the risk of penalties. Sage Payroll helped them stay compliant with all applicable laws and regulations. The company also benefited from the integrated time and attendance features of Sage Payroll, which streamlined their time tracking and payroll processing.

Challenges Faced and Solutions Found

Here are some common challenges businesses face when implementing payroll software and how Sage Payroll addresses them:

- Integration with Existing Systems: Many businesses have existing HR and accounting systems that they need to integrate with their payroll software. Sage Payroll offers seamless integration with a wide range of third-party applications, making it easy to connect with other systems and streamline data flow.

- Compliance and Regulatory Changes: Payroll regulations are constantly changing, and businesses need to stay up-to-date to avoid penalties. Sage Payroll provides access to the latest tax tables and regulatory updates, ensuring that businesses are compliant with all applicable laws.

- Security and Data Protection: Payroll data is highly sensitive, and businesses need to ensure that it is protected from unauthorized access. Sage Payroll uses advanced security measures to protect payroll data and comply with industry standards.

Positive Impact of Sage Payroll

Here are some of the key benefits businesses have reported after implementing Sage Payroll:

- Reduced Payroll Processing Time: Sage Payroll automates many of the manual tasks involved in payroll processing, significantly reducing the time and effort required. This allows businesses to free up their HR team to focus on other important tasks.

- Improved Accuracy and Compliance: Sage Payroll helps businesses avoid errors and ensure compliance with all applicable laws and regulations. This reduces the risk of penalties and ensures that employees are paid correctly and on time.

- Enhanced Efficiency and Productivity: By streamlining payroll processes, Sage Payroll allows businesses to improve efficiency and productivity. This can lead to cost savings and increased profitability.

- Better Employee Satisfaction: When employees are paid correctly and on time, they are more satisfied with their jobs. This can lead to improved employee morale and retention.

Key Factors for Successful Implementation

Here are some key factors that contribute to successful Sage Payroll implementations:

- Clear Objectives and Goals: Before implementing Sage Payroll, it is important to define clear objectives and goals. This will help ensure that the software meets the specific needs of the business.

- Proper Planning and Preparation: Proper planning and preparation are essential for a smooth implementation. This includes gathering data, training staff, and testing the system before going live.

- Effective Communication and Collaboration: Effective communication and collaboration between the implementation team, HR team, and other stakeholders are crucial for a successful implementation.

- Ongoing Support and Maintenance: After implementing Sage Payroll, it is important to provide ongoing support and maintenance to ensure that the system continues to function properly.

Future Trends in Payroll Software

The landscape of payroll software is constantly evolving, driven by technological advancements, changing regulatory environments, and the growing demand for efficiency and accuracy. Emerging trends are shaping the future of payroll, promising to revolutionize how businesses manage their workforce and navigate the complexities of payroll processing.

Automation and Artificial Intelligence in Payroll

The integration of automation and artificial intelligence (AI) is poised to transform payroll operations, streamlining processes and minimizing human error.

- Automated Data Entry: AI-powered tools can extract data from various sources, such as time and attendance systems, HR databases, and employee onboarding forms, and automatically populate payroll systems, reducing manual data entry and the risk of errors.

- Intelligent Tax Calculations: AI algorithms can analyze tax regulations and updates, ensuring accurate and compliant tax calculations, regardless of changes in legislation or employee location.

- Fraud Detection: AI can identify anomalies and potential fraudulent activities in payroll data, helping businesses prevent financial losses and ensure the integrity of their payroll systems.

Evolving Role of Payroll Professionals

As payroll automation and AI take over routine tasks, payroll professionals will need to adapt and evolve their skillsets to focus on strategic initiatives.

- Data Analytics and Insights: Payroll professionals will play a crucial role in analyzing payroll data to identify trends, optimize payroll processes, and support business decisions.

- Compliance and Regulatory Expertise: With ever-changing regulations, payroll professionals will need to stay updated on compliance requirements and ensure their organization adheres to all applicable laws.

- Strategic Partnerships: Payroll professionals will collaborate with other departments, such as HR and finance, to ensure seamless integration and optimize payroll operations within the broader business context.

The Future of Payroll Compliance and Regulations

The regulatory landscape surrounding payroll is constantly evolving, with new laws and regulations emerging regularly.

- Data Privacy and Security: Businesses will need to comply with increasingly stringent data privacy regulations, such as the General Data Protection Regulation (GDPR), ensuring the secure storage and processing of employee payroll data.

- Remote Work and Global Payroll: As remote work becomes more prevalent, businesses will need to navigate the complexities of managing payroll for employees in different locations, including international tax compliance and currency exchange rates.

- Real-Time Payroll: The move towards real-time payroll processing will allow employees to access their pay information and manage their finances more effectively. This will require businesses to adopt systems that can handle real-time data updates and calculations.

Conclusion

By automating payroll tasks, reducing manual errors, and providing real-time insights, Sage Payroll empowers businesses to focus on what matters most: growing their operations and achieving their goals. With its user-friendly interface, comprehensive features, and dedicated support, Sage Payroll offers a reliable and efficient solution for all your payroll needs.

Sage Payroll offers a robust system for managing employee compensation and benefits. But what about tracking project tasks and progress? For that, you might want to consider using Jira software , a popular tool for agile project management. Integrating Jira with Sage Payroll can streamline your workflow and provide a comprehensive view of your business operations.