Tax software sets the stage for this enthralling narrative, offering readers a glimpse into a world where complex tax calculations become manageable and filing deadlines are met with ease. It’s a story of innovation and convenience, where technology empowers individuals and businesses to navigate the intricacies of taxation with confidence.

Table of Contents

From its humble beginnings as a tool for simplifying individual tax returns, tax software has evolved into a multifaceted solution catering to diverse needs. Whether you’re a freelancer seeking to optimize deductions or a business owner managing intricate financial records, tax software provides a comprehensive platform for managing your financial obligations.

Key Features of Tax Software

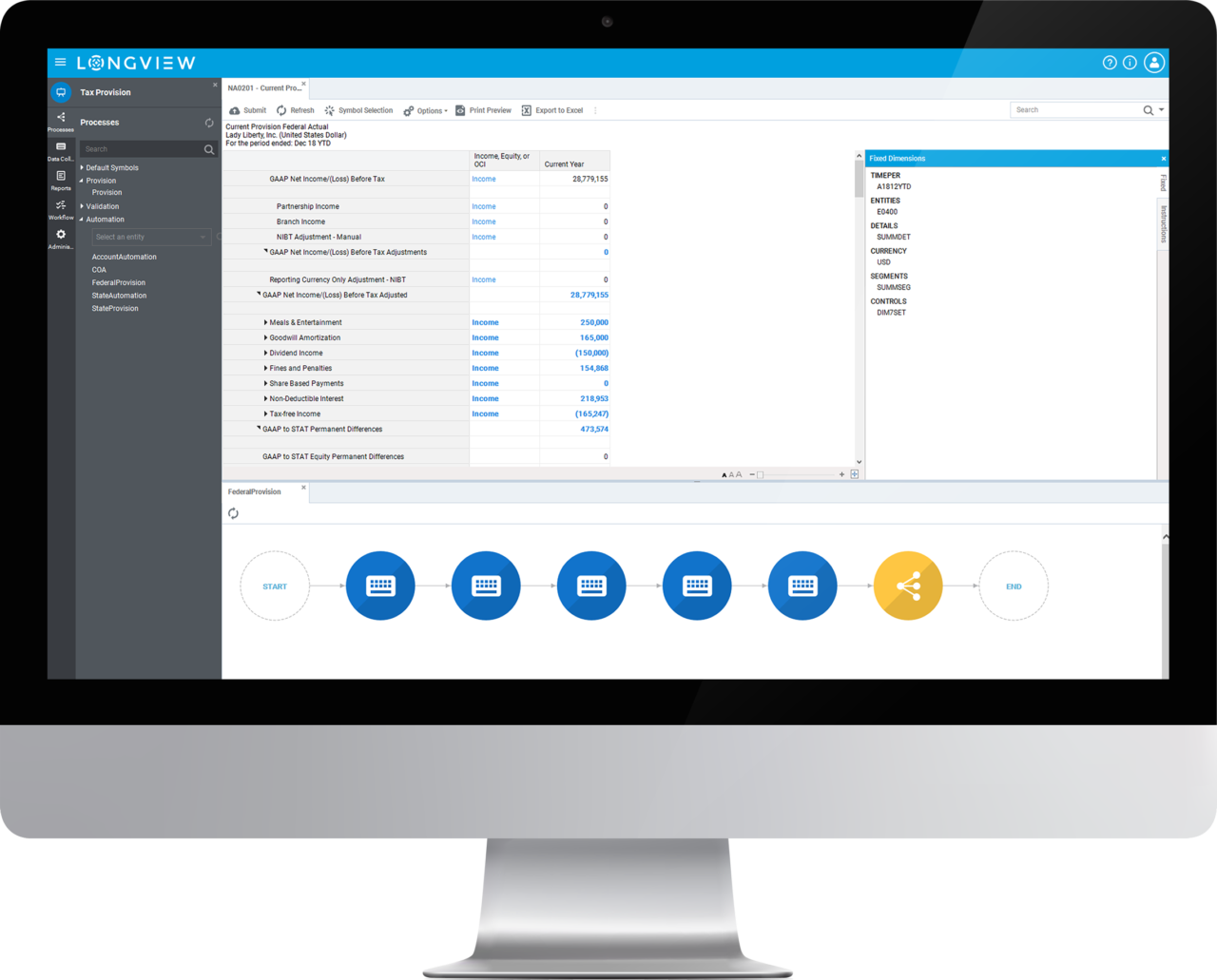

Tax software is designed to simplify the process of filing taxes and offers a range of features to help individuals and businesses accurately calculate and submit their tax returns. These features are crucial for navigating the complexities of tax regulations and ensuring compliance.

Tax Calculation and Filing

Tax calculation and filing are the core functions of tax software. They streamline the process of determining your tax liability and preparing your tax return. The software takes your financial information, such as income, deductions, and credits, and automatically calculates your tax obligations. It then generates the necessary forms and documents for filing with the relevant tax authorities. This eliminates the need for manual calculations and reduces the risk of errors.

Income and Expense Tracking

Effective income and expense tracking is essential for accurate tax reporting. Tax software provides tools to track your income from various sources, such as wages, investments, and self-employment. It also allows you to categorize and record your expenses, which can be used for deductions. The software often integrates with financial institutions, enabling automatic downloads of transactions, simplifying the tracking process.

Deduction and Credit Identification

Tax software helps identify potential deductions and credits you may be eligible for. It uses your financial data and personal information to match you with relevant tax breaks. The software provides explanations of each deduction and credit, making it easier to understand their impact on your tax liability. This feature can significantly reduce your tax burden by maximizing your tax savings.

Financial Data Import and Export

Tax software facilitates the seamless import and export of financial data. You can import data from various sources, such as bank statements, investment accounts, and payroll systems. This eliminates the need for manual data entry, saving time and reducing errors. The software also allows you to export your data in various formats, enabling you to share it with other applications or financial advisors.

Audit Trail and Record Keeping

Tax software maintains a detailed audit trail of all your tax-related transactions. This feature provides a comprehensive record of your income, expenses, deductions, and credits. The audit trail is essential for supporting your tax return if you are audited by the tax authorities. It ensures you have the necessary documentation to demonstrate the accuracy of your tax filings.

Benefits of Using Tax Software

Tax software offers a range of advantages over manual tax preparation, making it a popular choice for individuals and businesses alike. By leveraging technology, tax software simplifies the tax process, helps users avoid errors, and potentially maximizes tax savings.

Time Savings

Tax software streamlines the tax preparation process, saving users significant time compared to manual methods. It automates complex calculations, eliminates the need for manual data entry, and simplifies the organization of tax documents.

For example, instead of spending hours searching for receipts and manually calculating deductions, users can simply import financial data from their bank accounts and other sources directly into the software. This automated data entry eliminates the risk of errors and significantly reduces the time spent on tax preparation.

Reduced Errors

Tax software is designed to minimize errors by performing accurate calculations and providing built-in checks and balances. It ensures that users are complying with current tax laws and regulations, reducing the risk of penalties or audits.

Tax software incorporates error detection mechanisms, such as alerts for missing information or inconsistencies in data. This ensures that users are alerted to potential errors before submitting their tax returns, minimizing the risk of costly mistakes.

Maximized Tax Savings

Tax software helps users maximize their tax savings by identifying eligible deductions and credits. It provides personalized recommendations based on individual circumstances and helps users claim all the benefits they are entitled to.

For instance, tax software can help users identify deductions for charitable contributions, medical expenses, and homeownership. It can also guide users through the process of claiming credits for education expenses, child tax credits, and other eligible benefits.

Improved Organization

Tax software centralizes all tax-related documents in one secure location, making it easier to manage and organize tax information. This organized approach ensures that users have all the necessary documents readily available when filing their taxes, minimizing the risk of missing important information.

Tax software provides features like digital document storage, allowing users to securely store and access all their tax-related documents, including receipts, W-2s, and 1099 forms. This centralized approach simplifies the organization process and reduces the risk of losing important documents.

Tax Software Security and Privacy

Your financial data is extremely sensitive, and you want to make sure it’s safe when using tax software. This is especially true because you’re entrusting the software with your personal and financial information, including Social Security numbers, bank account details, and income records.

Data Security Measures

Tax software providers employ various security measures to protect your data. These measures are designed to prevent unauthorized access, use, disclosure, disruption, modification, or destruction of your information.

- Encryption: Most tax software providers use encryption to protect your data during transmission and storage. Encryption transforms your data into an unreadable format, making it difficult for unauthorized individuals to access it.

- Firewalls: Firewalls act as a barrier between your computer and the internet, blocking unauthorized access to your data. Tax software providers use firewalls to protect their servers and prevent hackers from gaining access to your information.

- Regular Security Audits: Tax software providers regularly conduct security audits to identify and address any vulnerabilities in their systems. This helps ensure that their security measures are effective and up-to-date.

- Multi-Factor Authentication: Many tax software providers offer multi-factor authentication, which requires you to enter a unique code sent to your phone or email in addition to your password when logging in. This extra layer of security makes it much harder for hackers to access your account.

Compliance with Regulations

Tax software providers are required to comply with various regulations that govern data privacy and security. These regulations ensure that your data is handled responsibly and protected from misuse.

- The General Data Protection Regulation (GDPR): The GDPR is a comprehensive data protection law that applies to companies processing the personal data of individuals in the European Union. Tax software providers that operate in the EU must comply with the GDPR’s requirements for data protection, including obtaining consent from users, providing transparency about data collection and use, and ensuring the security of personal data.

- The California Consumer Privacy Act (CCPA): The CCPA gives California residents more control over their personal data, including the right to know what data is collected, the right to delete data, and the right to opt out of the sale of their personal information. Tax software providers operating in California must comply with these requirements.

- The Health Insurance Portability and Accountability Act (HIPAA): HIPAA is a federal law that protects the privacy and security of protected health information (PHI). Tax software providers that handle PHI, such as tax returns with medical deductions, must comply with HIPAA’s regulations.

Safeguarding Your Information, Tax software

While tax software providers take steps to protect your data, you can also take steps to safeguard your personal financial information.

- Strong Passwords: Create strong passwords that are at least 12 characters long and include a combination of uppercase and lowercase letters, numbers, and symbols. Avoid using personal information like your name or birthdate in your password.

- Two-Factor Authentication: Enable two-factor authentication whenever it’s available. This adds an extra layer of security to your account, making it much harder for hackers to access your data.

- Keep Software Updated: Regularly update your tax software and operating system. Updates often include security patches that address vulnerabilities in the software.

- Be Aware of Phishing Scams: Be cautious of emails or phone calls that ask for your personal financial information. Tax software providers will never ask for this information over email or phone.

- Secure Your Computer: Install antivirus software and keep it updated. This will help protect your computer from malware that could steal your personal information.

Tax Software Comparison

Choosing the right tax software can be a daunting task, with numerous options available, each boasting unique features and pricing plans. This section delves into comparing popular tax software programs based on features, pricing, and user reviews to help you make an informed decision.

Comparison of Popular Tax Software Programs

The following table provides a comparison of popular tax software programs, highlighting their key features, pricing, pros, and cons:

| Software Name | Key Features | Pricing | Pros | Cons |

|---|---|---|---|---|

| TurboTax | – Guided interview process – Extensive support for various tax situations – Free edition for simple returns – Mobile app for on-the-go access |

$0-$129.99 | – User-friendly interface – Comprehensive features – Excellent customer support |

– Can be expensive for complex returns – Free edition has limited features |

| H&R Block | – Simple and intuitive interface – Free edition for basic returns – Access to tax professionals – Online and desktop versions available |

$0-$129.99 | – Easy to use – Affordable options – Tax professional support |

– Limited features compared to TurboTax – Can be slow to load |

| TaxAct | – Affordable pricing – Wide range of features – Free edition for simple returns – Live tax support available |

$0-$79.99 | – Value for money – Comprehensive features – Excellent customer service |

– Interface can be less intuitive than others – Limited mobile app functionality |

| FreeTaxUSA | – Completely free for federal and state returns – Simple and straightforward interface – Supports various tax situations |

$0-$19.99 | – Free for basic returns – Easy to use – No hidden fees |

– Limited features compared to paid options – No live support available |

It is important to note that the pricing for each software program can vary depending on the specific plan and state you reside in.

Strengths and Weaknesses of Each Software Program

Each tax software program has its own strengths and weaknesses, which can influence your decision.

TurboTax

TurboTax excels in its user-friendly interface, comprehensive features, and excellent customer support. However, its pricing can be expensive for complex returns, and the free edition has limited features.

H&R Block

H&R Block offers a simple and intuitive interface, affordable options, and access to tax professionals. However, its features are limited compared to TurboTax, and it can be slow to load.

TaxAct

TaxAct provides value for money, comprehensive features, and excellent customer service. However, its interface can be less intuitive than others, and its mobile app functionality is limited.

FreeTaxUSA

FreeTaxUSA is completely free for federal and state returns, making it an attractive option for those with simple returns. However, it has limited features compared to paid options and lacks live support.

Final Review

In the realm of tax software, the future holds exciting possibilities. With the advent of artificial intelligence and machine learning, tax filing is poised to become even more streamlined and intuitive. As technology continues to advance, tax software will continue to empower individuals and businesses to navigate the complexities of taxation with greater ease and efficiency.

Tax software can be a lifesaver during tax season, helping you organize your finances and file accurately. But what happens if your computer crashes and you lose all your tax data? That’s where data recovery services come in handy. They can help you retrieve lost files, including your tax information, so you can get back on track.

Once your data is recovered, you can use your tax software to file your taxes with confidence.